About Fix and Flip Loans

Fix and flip loans are short term private money loans taken by real estate investors for the purpose of rehabbing or "flipping" a property to resell it. These types of loans are almost always secured by the property and may or may not include rehab costs. They tend to carry higher interest rates than traditional bank loans but are often used in hot real estate markets where investors must have ready access to cash in order to close transactions quickly. They are also integral for more sophisticated investors who undertake many flips at one time since banks will rarely loan money for more than a few concurrent projects.

Investors who use hard money to flip properties must be highly diligent in managing their project timelines since the high rates of interest charged on the loans may end up consuming a bulk of their potential profits. Typically, these investors will incorporate the loan fees and interest into the project costs. Although most lenders prefer to make fix and flip loans to experienced rehabbers, some will work with new investors at higher interest rates and/or lower LTV's (loan-to-value).

Top Cities

- Houston, TX

- Chicago, IL

- Brooklyn, NY

- Los Angeles, CA

- Miami, FL

- San Antonio, TX

- New York, NY

- Philadelphia, PA

- Las Vegas, NV

- Bronx, NY

- Phoenix, AZ

- Dallas, TX

- San Diego, CA

- Minneapolis, MN

- San Jose, CA

- Denver, CO

- Austin, TX

- St Louis, MO

- Indianapolis, IN

- Atlanta, GA

- Tucson, AZ

- Orlando, FL

- Portland, OR

- Seattle, WA

- Fort Worth, TX

- Jacksonville, FL

- Milwaukee, WI

- San Francisco, CA

- Cincinnati, OH

- Charlotte, NC

- Columbus, OH

- Cleveland, OH

- Fort Lauderdale, FL

- Sacramento, CA

- St Paul, MN

- El Paso, TX

- Louisville, KY

- Tampa, FL

- Memphis, TN

- Pittsburgh, PA

- Detroit, MI

- Albuquerque, NM

- Oklahoma City, OK

- Baltimore, MD

- Washington DC, DC

- Salt Lake City, UT

- Fresno, CA

- Buffalo, NY

What Are Fix and Flip Loans?

Sometimes referred to as rehab loans or hard money loans, a fix and flip loan provides funding to a borrower for a period of 1-3 years for the purpose of renovations or repairs on a property of which the borrower intends to sell once the improvements are complete.

Many of these loans are offered through private investment firms. Fix and flip hard money loans provide the financing needed for properties that are intended to be improved upon and resold, thus "fix and flip" properties.

Other types of loans that can be used for all or part of a fix and flip project include:

- Refinance / Cash Out Loan

- Bridge Loan

- Home Equity Loan or Line of Credit

How Do Fix and Flip Loans Work?

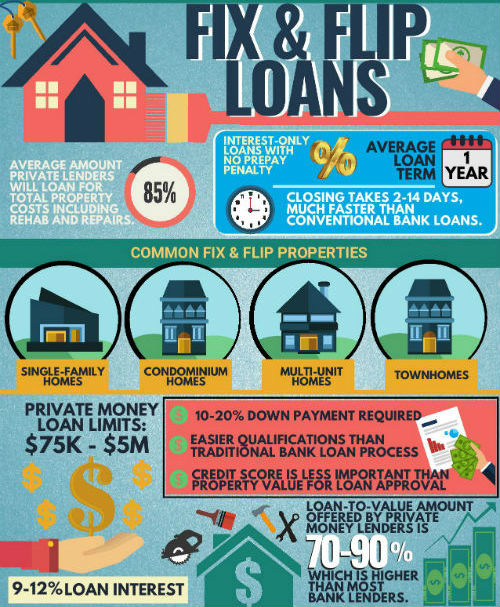

The average fix and flip hard money loan has a term of one year with a longer duration available. Hard money loans also require a relatively small down payment. Once approved, you will receive the loan for the home purchase and the first set of renovations. Once the contractor completes initial property improvements, you'll receive money for the next round of renovations, and so on.

The residential or commercial property is the collateral in a fix and flip loan. The lender finances the purchase of the property and the improvements or remodeling. The amount of financing depends on the lender's loan-to-value requirements. Hard money lenders will lend up to 85 percent of the property's estimated after-repair value (ARV). For fix and flip investment loans, the borrower repays the loan once the property is improved and sold.

What Are Common Types of Fix and Flip Projects?

- Single-family homes

- Multi-unit homes

- Duplexes or split residences

- Townhouses

- Condominiums

Loans To Pay For a Fix and Flip Project

Hard Money Loan

A hard money loan is a short-term loan secured by an asset such as real estate. Hard Money lenders are usually private investors, or a fund of investors. The interest rate is higher than traditional long-term bank loans and the repayment period is typically 2-5 years.

Refinance / Cash Out

This occurs when a property the borrower already owns is refinanced to finance the purchase of a new investment property. The new loan issued is considered a "first lien." This means that the original mortgage must be paid in full prior to receiving access to the equity accumulated. The difference between old loan and the new refinanced one is the cash the investor can use to finance improvement projects or property investments. This cash has no restrictions and can be spent on an owner occupied residence as well as an investment property or rental (up to four units).

Home Equity Loan or Line of Credit (HELOC)

A HELOC is similar to a credit card, in that it offers a line of credit based on the amount of equity in your home. These funds can be used for rehab fix and flip projects. This type of financing is a revolving loan with your property as the collateral. Some or all of the equity available can be loaned and interest accrues on only what is used. A line of credit allows you to withdrawal funds as needed but a home equity loan requires a lump sum distribution whether you end up needing all or just some of it.

Bridge Loan

Bridge loans secured by property are hard money loans, and hard money loans are considered to be short-term bridge loans, so the two are quite similar. A majority of those who use bridge loans do so in order to resell or rent, and to make a quick profit. The lenders of these short-term loans are typically small non-banking companies with a specialized knowledge of local real estate. Bridge loan funds can be disbursed as a series of payments or in a lump sum, with different amounts tied to the property purchase and the renovation. These funds typically have a higher interest rate and last a few weeks up to one year.

Other Loans

In some cases the party selling the property can offer a loan to the buyer. Other non-conventional ways of funding a fix and flip project is by partnering with someone who has the cash, receiving a loan from friends or family, borrowing from a retirement account or 401k, taking out a personal or business loan or line of credit.

Fix and Flip Loans vs 203K Loans

Two attractive financing options for fix and flip real estate investors are a 203K loan and a hard money loan. A 203K loan is a conventional mortgage loan backed by the Federal Housing Administration (FHA) for fix and flip investors that specializes in renovation of property. A hard money fix and flip loan is a real estate investment loan that is financed by a private lender instead of a bank.

A 203K loan has a 30 year term, with a reasonable APR of under 4 percent typically. With this type of mortgage, the investor is responsible for a minimum down payment of at least 3.5 percent of the total property and project cost. There are restrictions regarding the type of renovations permitted for this loan.

With a fix and flip loan from a hard money lender, the investor typically needs to bring more capital to the project. A hard money fix and flip loan will finance up to 85 percent of the total deal cost, on average. This requires up to 20 percent out-of-pocket from the borrower. Interest rates can range anywhere from 9 to 12 percent for these short term fix and flip loans.

Fix and flip hard money lenders tend to be more flexible when it comes to lending criteria, underwriting guidelines, and the speed of closing the deal.

How to Qualify for a Fix and Flip Loan

To qualify for a rehab or a fix and flip hard money loan, the following is required:

Credit Score must be 550 or above (the higher the better) and debt to income ratio typically cannot exceed 45 percent. Prior fix and flip projects or working with a licensed contractor can help in the approval process as well. Hard money loans offer comparatively easy qualifications when compared to other financing options.

Unlike conventional loans, fix and flip lenders place more importance on the property value, instead of the credit history or score. It takes less than a week typically to secure a fix and flip hard money loan since the property value is the prominent factor more than the buyer's credit or financial history.

Fix and flip lenders offer a lower loan-to-vale ratio than conventional loans, but it is based on the estimated value of the home after repairs are made. This fix and flip loan amount can result in a higher loan amount than what a bank will offer.

Hard money fix and flip loans typically come with relatively high interest rates. For this reason, most borrowers try to use fix and flip loans for a short duration, but these loans can go a few years or more if needed.

Where to Get a Fix and Flip Loan

Many rehabbers both novice and experienced, will turn to hard money lenders as the go-to for fix and flip loans. Fix and flip hard money loans can be obtained from hundreds of private financial firms both small and large. Many of these lenders can be found locally or online by the click of a mouse, but it is important to research for complaints and compliance.

In addition, there are a variety of private hard money crowdfunding platforms online where multiple investors pool their money to finance various residential and business fix and flip properties.

Lastly, sometimes the existing property owner may be able to provide financing for the a fix and flip deal.

Recent Topics

View All

5 Steps in Obtaining a Hard Money Loan

It may seem obvious, but nobody just googles the term "hard money loan" and gets the money they need for a home or remodel. There is a process to follow, as with any loan. The fact that hard money loans are faster and require less paperwork than a standard mortgage from big banks does not mean that...

Read More

Legitimate vs Predatory Lenders

Anytime a borrower seeks out alternative or special financing, like a hard money loan, it is extremely important to do the homework. Everyone considering a hard money loan should know what to expect, how to evaluate the options presented and what kinds of documentation will be expected at closing. ...

Read More

Types of Private Money Loans

Many property buyers look for alternatives to the big bank loan process that can take a long time to fund and often require excessive paperwork. There are many different types of special financing available. This is a short overview of some of the options US buyers have today. Hard money refers to...

Read MoreView By State

- Alaska

- Alabama

- Arkansas

- Arizona

- California

- Colorado

- Connecticut

- Washington DC

- Delaware

- Florida

- Georgia

- Hawaii

- Iowa

- Idaho

- Illinois

- Indiana

- Kansas

- Kentucky

- Louisiana

- Massachusetts

- Maryland

- Maine

- Michigan

- Minnesota

- Missouri

- Mississippi

- Montana

- North Carolina

- North Dakota

- Nebraska

- New Hampshire

- New Jersey

- New Mexico

- Nevada

- New York

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Virginia

- Vermont

- Washington

- Wisconsin

- West Virginia

- Wyoming

Your Information is Processing

Your Information is Processing